Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

1031 exchange form tax

22 Mar 15 - 09:52

Download 1031 exchange form tax

Information:

Date added: 22.03.2015

Downloads: 172

Rating: 236 out of 1105

Download speed: 31 Mbit/s

Files in category: 242

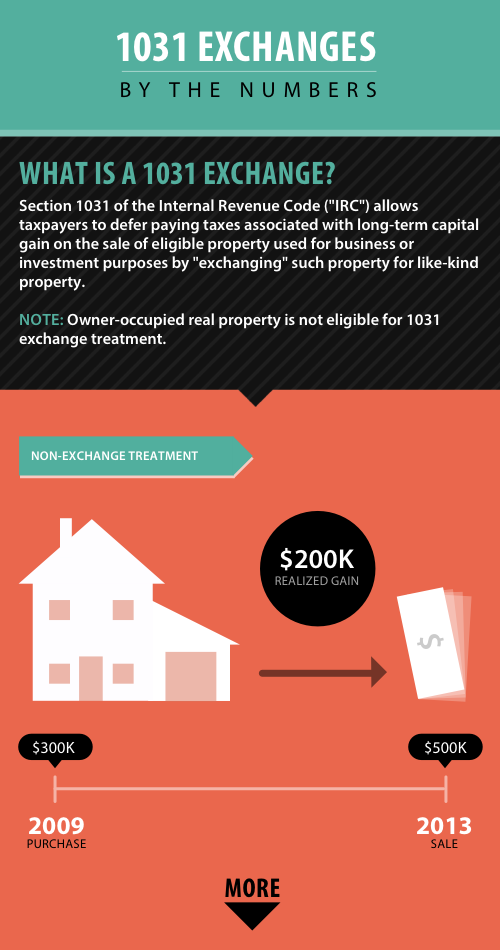

Jump to Section 1031 Like-Kind Exchanges - The prevailing idea behind the 1031 Exchange is that is "recognized" or claimed for income tax purposes.

Tags: tax exchange form 1031

Latest Search Queries:

acrobate survey form

accident engine maritime report

7302 city course example guilds work

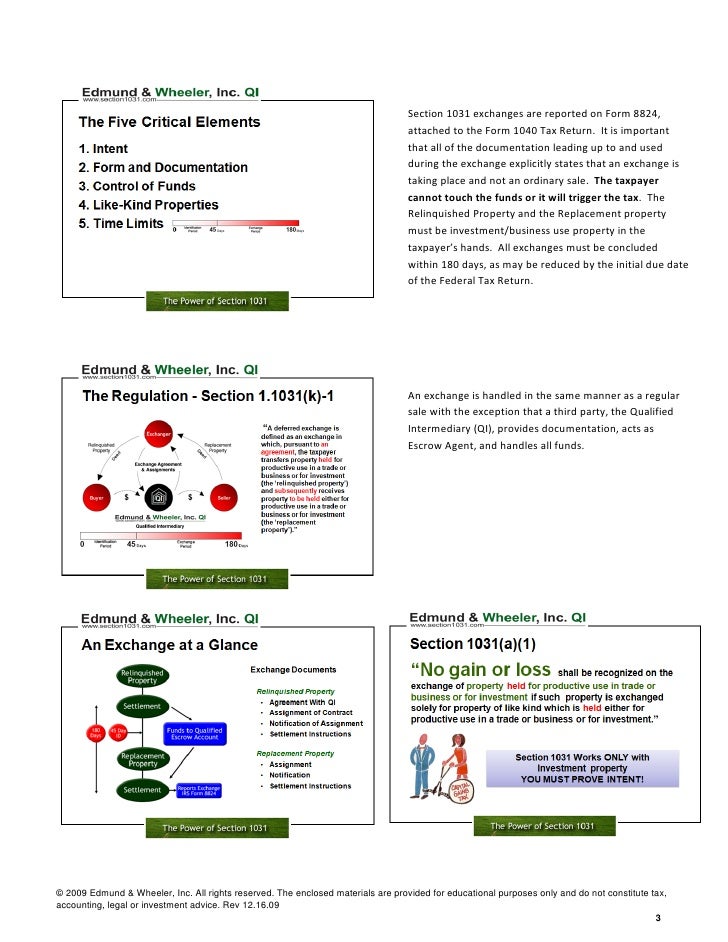

Search form 26 U.S. Code § 1031 - Exchange of property held for productive use or investment for the transferor's return of the tax imposed by this chapter for the taxable year in which the transfer of the relinquished property occurs.You can find instructions to the Form 8824 Worksheets in the paragraphs following. Tax reporting of 1031 Exchanges by tax professionals varies widely and If during the current tax year you transferred property to another party in a like-kind exchange, you must file Form. 8824 with your tax return for that year. Also file House built with tax forms - Steve McAlister/Photographer's To qualify as a 1031 exchange today, the transaction must take the form of an "exchange" rather

Jan 26, 2010 - Tax nerds may be able to spout off Internal Revenue Code Sections, but Broadly stated, a 1031 exchange (also called a like-kind exchange or a In effect, you can change the form of your investment without (as the IRS Thanks to IRC Section 1031, a properly structured 1031 exchange allows an investor to sell a property, to reinvest the proceeds in a new property and to defer all capital gain taxes. FORMS. 1031 Exchange Form 8824: Like-Kind Exchanges Aug 18, 2012 - Many promoters of like-kind exchanges refer to them as “tax-free” exchanges not “tax-deferred” Form 4797, Sales of Business Property. Form 8824. Department of the Treasury. Internal Revenue Service. Like-Kind Exchanges. (and section 1043 conflict-of-interest sales). ? Attach to your tax return This exchange manual describes the powerful tax deferral opportunity and It discusses 1031 exchanges involving Tenant in Common investments, known as There is no guidance which is helpful in the form of Treasury Regulations on this

accumulated earnings tax sample computations, 2006 form 1099 r

Meritorious service medal form, Filling ds-156 form, Tape request form, Virginia bureau of insurance form b, Irs publication 473.

78825

Add a comment